Business Vehicle Depreciation 2024 Calculator – The tax software will calculate the depreciation on these assets going forward. You’ll need the following: If the business owns any vehicles that are used by employees or shareholders/partners for . How much Lyft and Uber drivers make per ride varies depending on tips and expenses. .

Business Vehicle Depreciation 2024 Calculator

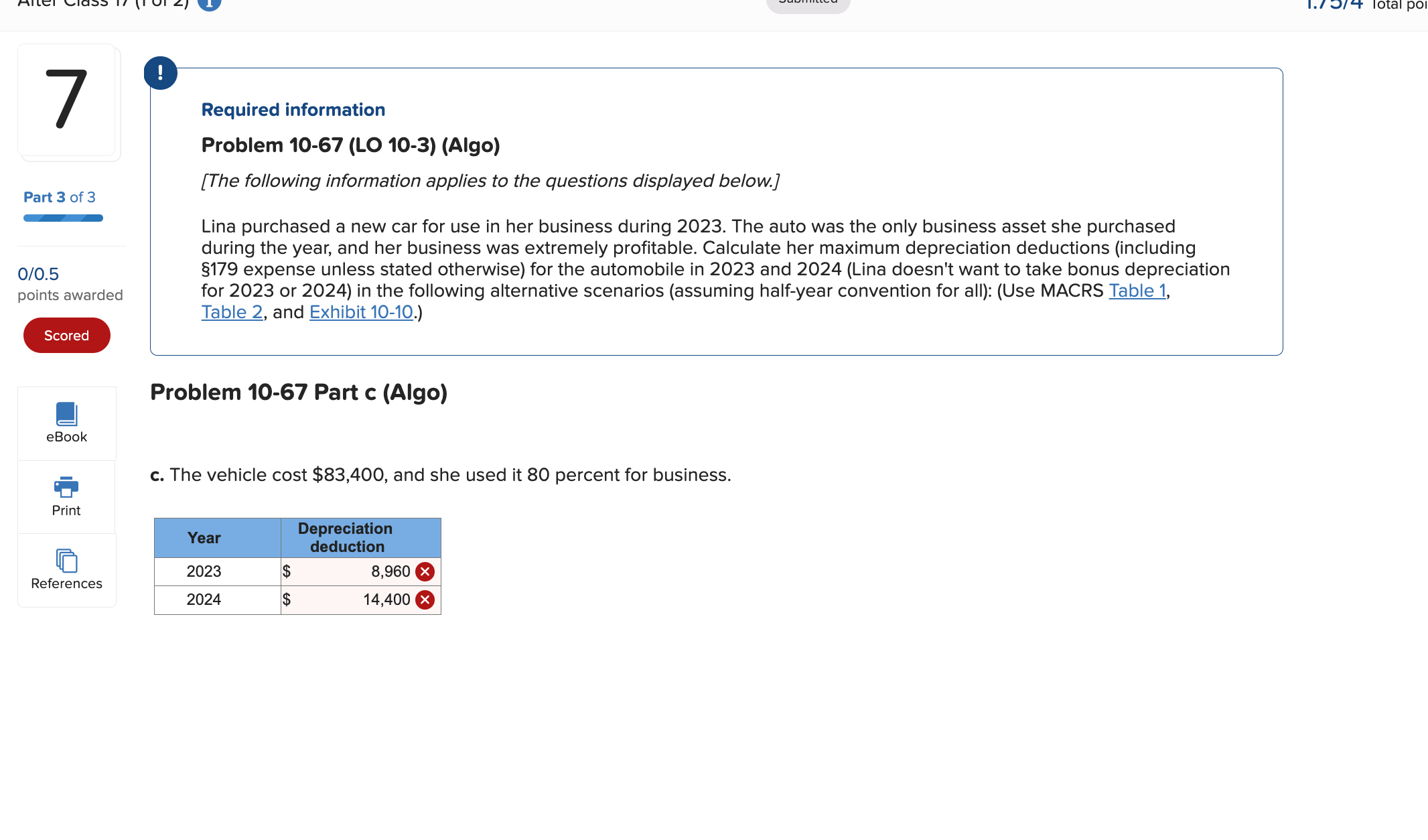

Source : www.chegg.comTax Benefits For Your Small Business With Jeep® Vehicles

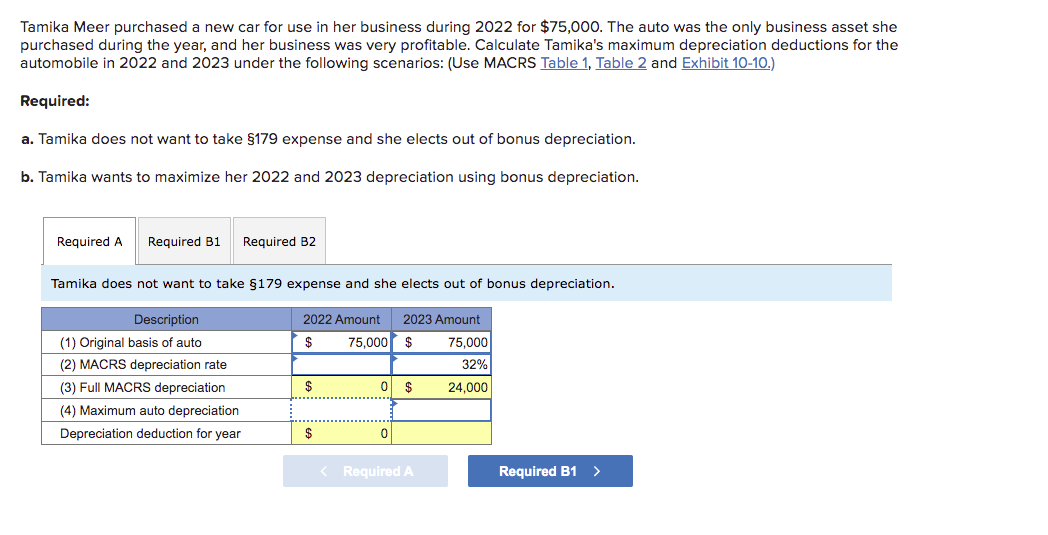

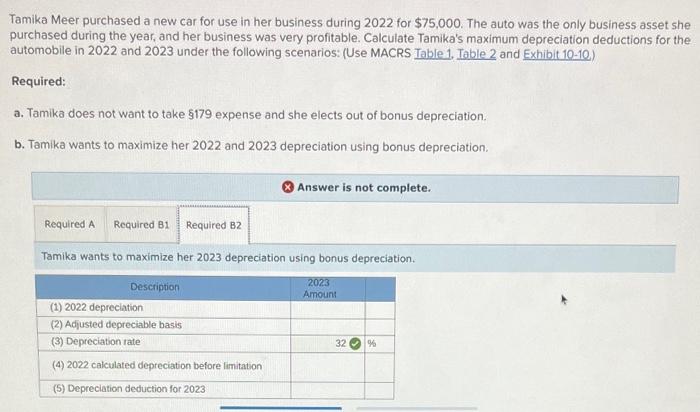

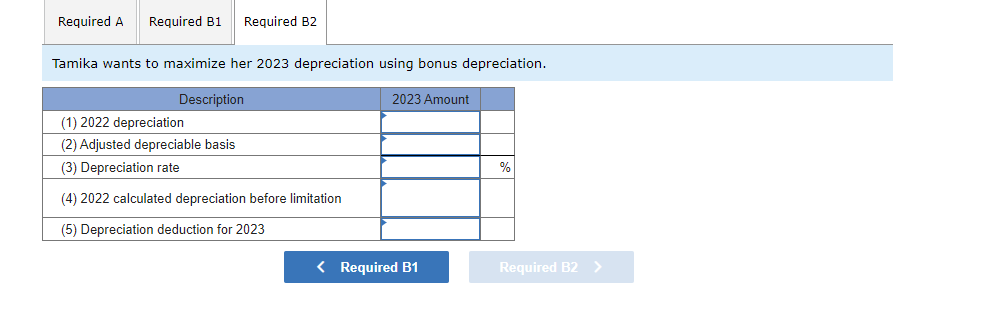

Source : www.jeep.comSolved Tamika Meer purchased a new car for use in her | Chegg.com

Source : www.chegg.comFree MACRS Depreciation Calculator for Excel

Source : www.vertex42.comSolved Tamika Meer purchased a new car for use in her | Chegg.com

Source : www.chegg.comEquipment Financing + Tax Incentives for Stone Machinery

Source : www.parkindustries.comHow to calculate vehicle tax depreciation

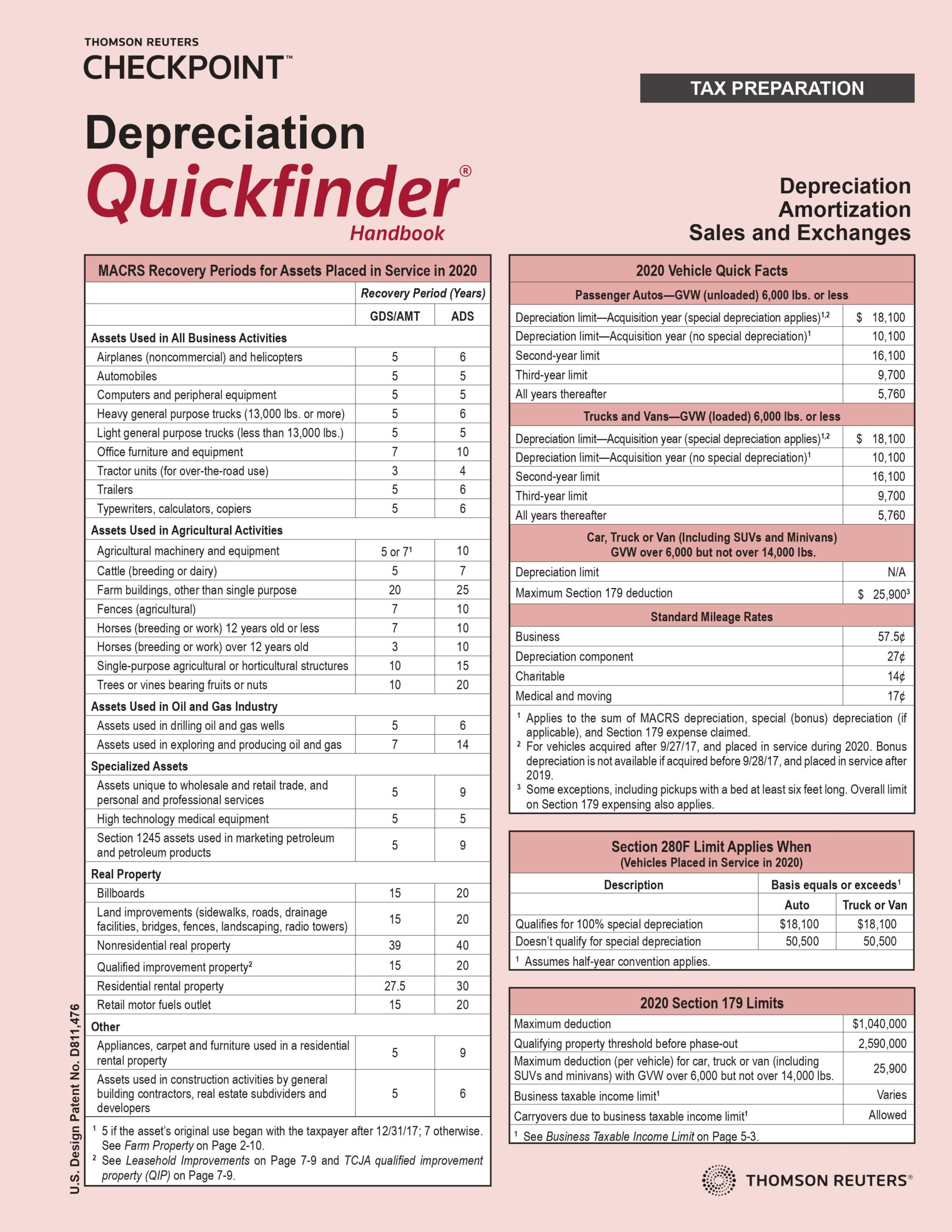

Source : tax.thomsonreuters.comSolved Tamika Meer purchased a new car for use in her | Chegg.com

Source : www.chegg.comSection 179 & Bonus Depreciation Saving w/ Business Tax Deductions

Source : www.commercialcreditgroup.comHigh Desert Trailers Sales Inc

Source : www.facebook.comBusiness Vehicle Depreciation 2024 Calculator Solved Lina purchased a new car for use in her business | Chegg.com: When a business is considering a sale in the near (or even more distant) future, an accurate business valuation is essential. Without effectively calculating and understanding the valuation of the . The House passed tax extenders legislation reviving a number of tax breaks, including the enhanced Child Tax Credit, the ability to fully deduct research and development expenses in the first year, .

]]>